As Africa’s climate financing needs continue rising steadily, green bonds are being seen as one of the best promising avenues for funding the continent’s energy transition and sustainable development.

Success stories are already emerging from countries like Nigeria and Kenya, but experts warn that Uganda must act cautiously to avoid the risks of green-washing and unsustainable debt.

In simple terms, a green bond, also called a climate bond, is a type of loan that an organisation acquires or uses to raise money for projects that help in environment protection or to fight climate change. These initiatives are gaining more popularity in Africa in just a few years.

In June 2025, Nigeria, currently the major player on the continent, managed to raise USD59 million through green bonds and this happened in just two days. It follows earlier successful supply in 2017 and 2019.

The funds were directed towards renewable energy, eco-friendly housing, and various conservation initiatives. But to attract investors, Nigeria, Africa’s most populated country, had to pay interest rates as high as 19 percent, reflecting the perceived risks of lending in Africa’s markets.

Kenya also entered the green bond market in 2019 when a private developer identified as Acorn Holdings raised more than USD40 million to fund environmentally friendly student housing project.

In addition, Ivory Coast, Tanzania, and South Africa have, too, issued green bonds, with Ivory Coast securing UDS1.5 billion in 2024.

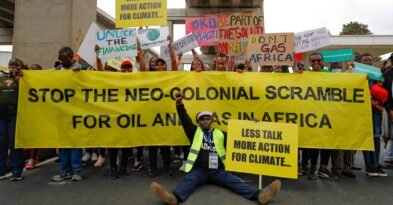

Despite this momentum, Africa’s share of the global green bond market remains small. In 2023, the continent accounted for about 5 billion dollars of the 2.2 trillion dollars in global green bond issuance, according to the Africa Policy Research Institute. Analysts point to currency depreciation, high inflation, political risks, and a lack of well-prepared projects as key challenges.

Uganda’s cautious first steps

Uganda is yet to issue a sovereign green bond. But discussions are under way, with policymakers and regulators working to lay the foundation for the country’s entry into the market.

In April 2025, the Government of Uganda, through the Ministry of Finance, Planning and Economic Development (MoFPED)’s Climate Finance Unit, in partnership with the Climate Change Department at the Ministry of Water and Environment and with support from the Global Green Growth Institute (GGGI) successfully organised a four-day capacity-building on Climate Change Budget Tagging (CCBT).

The training was conducted under the Creation of the Climate Finance Unit project and the Support Program to Enhance Access and Retention of Climate Finance in Uganda (SPEAR-CF), which is supported by the British High Commission and the UK Foreign, Commonwealth & Development Office (FCDO), and the European Union, respectively.

This training aimed to enhance stakeholders’ capacity to develop climate-responsive Programme Implementation Action Plans (PIAPs), identify climate-related activities to be fed into the Programme Budgeting System (PBS), and integrate into the national planning and budgeting cycle for FY 2025/26.

Officials at the Ministry of Finance and the Capital Markets Authority (CMA) say Uganda is developing a national green bond framework.

“We are working towards a framework that will guide the issuance of green bonds in Uganda. The goal is to ensure credibility and investor confidence,” said a senior official at the Ministry of Finance, who requested anonymity.

However, Uganda hopes to attract private sector participation as well. Green bonds could be issued not only by government, but also by corporations, banks, or project developers seeking to finance renewable energy, climate-resilient infrastructure, sustainable agriculture, or improved waste management.

Promise and risk

Green bonds offer the potential to help Uganda finance key climate goals, including its energy transition. Possible projects include solar and wind power, small hydropower, clean transport systems, climate-smart agriculture, and flood control measures.

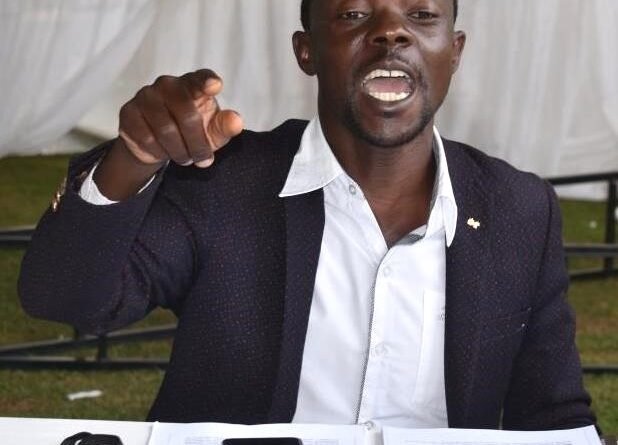

“Using green bonds can help Uganda can raise large amounts of money to support climate-friendly projects. But we must be extremely careful not to replicate mistakes seen elsewhere,” said Yisito Kayinga Muddu, a climate finance expert at Community Transformation Foundation Network (COTFONE) in Uganda.

According to Kayinga, the country needs to ensure projects are well-designed, directly involve communities, and ultimately deliver actual environmental benefits.

END;